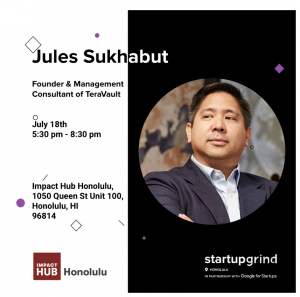

HI Tech Hui partner, Jules Sukhabut of TeraVault sat down for an interview with Impact Hub in preparation of his event with Startup Grind Honolulu.

HI Tech Hui partner, Jules Sukhabut of TeraVault sat down for an interview with Impact Hub in preparation of his event with Startup Grind Honolulu.

“Andrea Bertoli (AB): What is your background and history – tell us the founding story of TeraVault.

Jules Sukhabut (JS): TeraVault is a boutique software development firm. In September 2018, we partnered with Hi Tech Hui, a cyber security company in Honolulu to help some of their clients with software projects, and we’ve been growing ever since. Currently we have team members in both Honolulu and LA, and we are growing our offshore team in Philippines who service clients on the mainland and Canada.

Before starting this company, I started and sold three others: WebWorks, Bagna Networks, and OrderDynamics. I have had successful exits from all of these companies.

AB: What advice can you share for entrepreneurs as they grow and scale their company?

JS: Sell through channel partners- In my experience, I found it easier to sell through channel partners. In the early days of a startup I sold through other companies that I knew and that had similar target clients. This strategy has allowed our company to quickly grow our SaaS or IaaS sales and client base, and allowed us to test and develop our sales processes, onboarding, and ongoing support.

This is not an original idea, it’s basically why some software companies sell through retailers, independent software vendors (ISV), value added resellers (VAR), and/or systems integrators (SI).

Another piece of advice is to attend trade shows and conferences: I’m always looking for trade shows and conferences in the market location that I’m targeting for sales. These are usually in the same industry as our company’s product / services is in (e.g. e-commerce), or in an industry that my target client is in (e.g. clothing retailers and brands). Once I identify these events, I start creating a workback schedule to exhibit and demo our product/services there.

AB: What are some of the key lessons that you’ve learned along the way?

JS: Don’t take on investors early in your company- In all the companies that I’ve co-founded, we didn’t take any outside investment from investors. We did take on debt/loans to help our business grow, but this didn’t dilute our shares and ownership. This helped us maintain control and direction of our company while allowing the founders realize the capital gains of our shares in the company when we sold. I do, however, agree with taking on investors (private or corporate) at later stages in the business, but only if the investment capital is used to significantly grow company sales or solidify a strategic partnership or product development.

AB: What can people expect from the coming Startup Grind event?

JS: At the coming Startup Grind event, I will share my personal experiences of starting a technology company, growing it nationally and internationally, and exiting the business through an acquisition and management earn out.”

For more information on TeraVault, Impact Hub, or Startup Grind check out their websites! We hope to see you at the event on Thursday July 18th, 2019. To register: HERE